However, many marketers become enamored with the latest technology and jump into marketing automation without considering the human investment and business processes needed to make their efforts successful. If you focus on the technology over the planning, you won’t have the backbone necessary to support your marketing automation efforts and convert more leads into sales.

However, many marketers become enamored with the latest technology and jump into marketing automation without considering the human investment and business processes needed to make their efforts successful. If you focus on the technology over the planning, you won’t have the backbone necessary to support your marketing automation efforts and convert more leads into sales.

Whether you’re considering marketing automation or have already begun the process, you must understand exactly what you can – and can’t – achieve with the software. Here are five things you shouldn’t expect marketing automation software to do:

- Model how your buyers buy. A key to marketing automation is reframing your thinking to focus on your customers’ buying process rather than your selling process. Before you implement a marketing automation program, you should map how your customers move through every stage of the buying cycle and become aware of their questions and concerns throughout each stage.

- Define buyer personas. For your marketing and sales efforts to succeed, you need to understand your buyers’ challenges. One of the best ways to get inside a buyer’s head is to develop a profile of your ideal customer that includes his/her demographic, firmographic and psychographic details. You can even give your ideal customer a name and hang a photo of him/her near your computer.

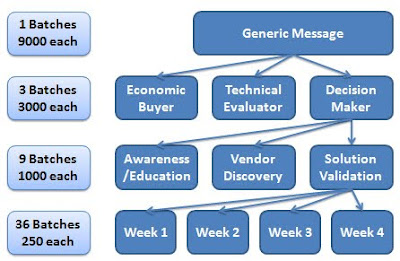

Buyer personas enable you to create targeted marketing materials that speak to your customers’ exact needs. If your marketing automation program sends your buyers information that is off-target, they will ignore your messages.

- Get sales and marketing to agree on what a qualified lead looks like. How often does your sales department complain about the quality of the leads you send them? Unless your marketing department has sales intuition (the ability to read your prospects’ behaviour and anticipate their next actions), defining a good lead will be difficult to do on your own. Meet with your sales team and discuss what makes a lead “qualified.”

- Create interesting and relevant content. Many marketers fail to consider the amount of educational content necessary to address their buyers’ concerns. For example, a customer in the early stages of the buying cycle might want to read articles and white papers, while someone who is closer to making a purchasing decision is more likely to request sales literature or product demos. While a marketing automation system will deliver the content, you’ll still need to develop a content strategy and create engaging communications.

- Engage with others through social media. Marketing automation allows you to communicate with your leads without human interaction. However, human interaction is vital to your success with social media. Although some aspects of social media can be automated (such as inserting sharable links into emails and landing pages), you still need to personally interact with your online communities. One-on-one conversations with buyers can help you discover what messages are the most relevant to them.

After you lay the initial groundwork, marketing automation software can help you eliminate repetitive marketing tasks and increase your ROI. Here are three things marketing automation can do for you:

- Understand individual buyers. Marketing automation software collects powerful data about your buyers to help you understand their interests and needs. The software follows the footprints buyers leave on your website and shows you what content they have accessed. This means you can gain a deeper understanding of your customers and have an advantage over competitors who are not using marketing automation.

- Deliver the right message – at the right time – to each buyer. One of the biggest benefits of marketing automation software is its ability to deliver targeted content to your leads throughout every stage of the buying cycle. For example, if a lead responds to a campaign about your XYZ solution, your program can send her a case study about a customer who achieved strong business gains after implementing your solution. Imagine how this targeted information can educate your leads and convert more of them into customers.

- Identify the right leads for sales. Once you and your sales team identify what makes a lead “qualified,” marketing automation can help you deliver those leads to sales. Your sales team can view specific data about your prospects, including the links they clicked, the registration forms they completed and their lead scores. This detailed information makes it easier for your sales team to reach their quotas.

A successful marketing automation program involves more than just implementing the latest technology. Have you considered the sales and marketing processes you’ll need to make it work for you?

(this post originally ran as a guest post on Astadia's marketing automation blog)

.