There has been a lot of great discussion lately about the business case for

marketing automation. For obvious reasons, I'm excited to see the discussion, but it often takes an interesting turn. The way in which people often attempt to measure it is in either efficiency gains, or revenue gains -

when compared with a manual process for marketing in the same way.

This is the comparison I see a challenge with, and viewed in that light, it will be hard to see the level of value that is being seen today by the

best marketers.

If you look at what

marketing automation does in terms of business transformation, it is insufficient to characterize it in terms of simply just an efficiency gain, or a revenue gain. It changes the way that we, as B2B marketing organizations, are able to interact with prospects, and opens up new avenues of prospect understanding and prospect communication that simply would not have been viable without marketing automation.

A comparison is the transition from film to digital cameras. If you look at what is possible with film cameras, in terms of photo sharing, digital editing, virtually unlimited photo storage, and the social media use of photos, it is clear that digital cameras present an entirely new way of interacting with images. If contemplated from a framework of film photography, you might look at something like sharing a photo to Facebook and think of digital cameras as offering an efficiency gain; it’s possible with film, you just snap the photo, develop it, scan it, save it to a file, and then upload it. Much less “efficient” but still possible.

However, this misses the point. These things are not simply spectrums of efficiency or revenue, as there is a certain point at which the task would simply not be done.

If you look at the business process that

B2B marketers using marketing automation are working to enable, it has a similar challenge. A simple way of looking at it is that we are seeking to:

a) Understand prospective buyers through reading their

digital body languageb) Communicate with them accordingly, either through

lead nurturing when they are early in their buying process, or through sales engagement if they are later in their buying process

The challenge with making a direct comparison between marketing as enabled and automated with today’s marketing automation software platforms, and marketing without using automation is that the level of buyer understanding and engagement being sought is simply not attainable without automation in any practical way.

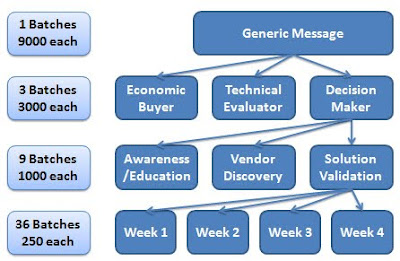

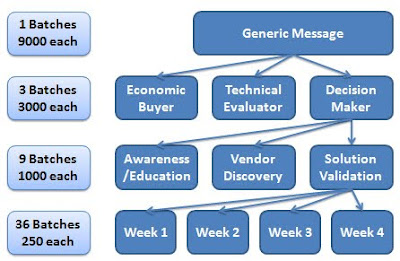

To put the marketing situation in context, using marketing automation, we are attempting to deliver the right message to the right buyer at the right time. This means that we might use digital body language to understand the buyer’s role in the buying process (technical evaluator vs economic buyer), we might seek to understand where they are in their buying cycle (awareness/education vs vendor discovery vs solution validation), and we might attempt to time a message a week after they last engaged with us in order to remain top of mind.

Building this with outbound, batch and blast marketing solutions leads to a fundamental problem. Even with this simple version of buyer understanding and message personalization, the level of personalization required quickly moves you from a single communication per month, of perhaps 9000 recipients, to 36 individual communications, each only going to 250 people. On top of this, the lack of built-in awareness of buyers’ digital body language would mean that you had 36 individual segments to select, based on an off-line analysis of the prospect’s behavior.

This leaves us in a similar comparison to the digital vs film photography example. Much as sharing photos on Facebook is

theoretically possible using film photography, but in

practical terms virtually impossible, marketing in a way that understands and responds to buyers’ digital body language is, in any practical terms, impossible without marketing automation software. You must compare one overall approach with another, and understand it in aggregate.

So, when compared in aggregate, it is tempting to come back to the argument that it only makes sense in terms of a revenue gain or a cost decrease. This is not altogether false, but must be understood in context of your overall market. As it is

not possible to truly understand and respond to the unique buying process of each of your buyers without a marketing automation solution, the comparison must now be understood in the context of the competitive landscape. If your competition is understanding and engaging the prospective buyers in your industry based on their individual buying processes, while you are not, they will have access to revenue that you simply will not have access to.

Framing the argument in terms of marketing automation allowing an increase in the efficiency, or the output of an existing revenue generating process is ignoring the fact that marketing automation allows a fundamental, and much needed, change to the revenue generation process itself.

In this panel discussion, Michael Williams of McAfee, Daniel Greenberg of TrialPay, and Chris Boorman of Informatica dug into the question from three very interesting angles and showed exactly what they had done in their respective businesses to rethink marketing as a revenue engine and drive business for the organization.

In this panel discussion, Michael Williams of McAfee, Daniel Greenberg of TrialPay, and Chris Boorman of Informatica dug into the question from three very interesting angles and showed exactly what they had done in their respective businesses to rethink marketing as a revenue engine and drive business for the organization.

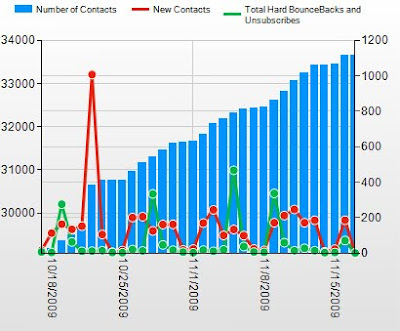

One of the most commonly cited benefits of implementing a marketing automation system is the opportunity to improve your organization’s ability to analyze marketing effectiveness. This is indeed possible, and provides a powerful advantage to organizations who are successful. However the final outcome of great

One of the most commonly cited benefits of implementing a marketing automation system is the opportunity to improve your organization’s ability to analyze marketing effectiveness. This is indeed possible, and provides a powerful advantage to organizations who are successful. However the final outcome of great